Why CAC is Skyrocketing (And How Native Apps Are the Antidote)

Customer acquisition costs have reached unsustainable levels across retail and DTC. Here’s why it’s happening—and how forward-thinking brands are breaking free.

2 October, 2025

If you’re a CMO or CEO watching your customer acquisition costs climb month after month, you’re not alone. Across retail, DTC, and B2B commerce, brands are facing the same brutal reality: it’s getting exponentially more expensive to acquire customers through traditional digital channels.

The numbers tell a stark story. Meta ads that delivered $3-4 ROAS just two years ago are now struggling to hit 2x return. Google Shopping costs have increased by 40-60% in many categories. Email open rates continue their steady decline as inboxes become increasingly crowded.

But why is this happening, and what can you do about it?

The Perfect Storm Behind Rising CAC

1. The iOS 14.5 Privacy Apocalypse

When Apple introduced App Tracking Transparency in iOS 14.5, it fundamentally broke the attribution model that powered Facebook and Google’s advertising engines. With over 80% of users opting out of tracking, platforms lost the granular data that made their targeting so effective.

The result? Brands are bidding blind, driving up costs while conversion rates plummet. What used to be precision targeting became spray-and-pray advertising overnight.

2. Platform Saturation and Competition

Every brand is fighting for the same digital real estate. As more businesses shifted online during the pandemic, advertising inventory became scarce while demand exploded. Simple supply and demand economics took over—costs skyrocketed.

Consider this: there are now over 2 million active advertisers on Facebook alone. That’s 2 million businesses bidding against each other for your customer’s attention.

3. The Third-Party Cookie Death March

With Google phasing out third-party cookies and browsers implementing stricter privacy controls, retargeting—once the backbone of efficient customer acquisition—has become increasingly ineffective. Brands are losing the ability to nurture prospects across the web.

4. Creative Fatigue at Scale

In the race to feed the algorithm, brands are burning through creative assets faster than ever. What used to be evergreen campaigns now require constant refreshing. The cost of producing enough content to maintain performance has become a significant hidden expense.

5. Changing Consumer Behavior

Today’s consumers are more selective, more skeptical of advertising, and increasingly immune to traditional acquisition tactics. They’re researching more, comparing more, and taking longer to convert. This extended consideration phase drives up acquisition costs while reducing immediate returns.

The Real Cost of Rising CAC

For many brands, customer acquisition has become a losing game. When your CAC approaches or exceeds your customer lifetime value, growth becomes unsustainable. We’re seeing:

- Reduced marketing ROI across all paid channels

- Pressure on unit economics as margins get squeezed

- Slower growth as acquisition budgets hit efficiency walls

- Increased dependency on discounting to drive conversions

- Short-term thinking that sacrifices long-term customer relationships

Why Mobile Web Isn’t the Answer

Many brands have responded by doubling down on mobile web optimization. While important, this approach has fundamental limitations:

Mobile web experiences are inherently fragmented. Customers bounce between browsers, clear cookies, and switch devices—making attribution and personalization nearly impossible.

Conversion rates remain stubbornly low. Even the best mobile web experiences typically convert at 50-75% of desktop rates. You’re still playing catch-up.

Retention mechanisms are limited. Without push notifications or persistent user sessions, re-engaging mobile web users requires expensive remarketing campaigns.

The Native App Alternative: Turning CAC into LTV

Forward-thinking brands are breaking free from the CAC spiral by transforming their mobile strategy. Instead of competing in crowded advertising auctions, they’re building direct, owned relationships through native mobile apps.

The Economics Are Compelling

2-3x higher conversion rates. Native apps consistently outperform mobile web because they’re faster, more intuitive, and eliminate friction at every step.

5x better retention. App users visit more frequently, stay engaged longer, and develop stronger brand affinity than mobile web visitors.

Direct communication channel. Push notifications deliver 5-7x higher engagement rates than email, giving you a direct line to customers without paying for each interaction.

Rich customer data. App users provide first-party data through usage patterns, preferences, and behaviors—data you own and control.

Real Results from Real Brands

The proof is in the performance. Brands using Poq’s native app platform are seeing transformational results:

Hobbycraft saw 14% of all digital revenue flow through their app within months of launch, with 80% of app-generated loyalty rewards being redeemed in physical stores.

E.L.F. Beauty achieved triple-digit growth in both revenue and downloads after moving to native, with repeat rates 150% higher than their previous mobile experience.

Three Strategies to Reduce CAC Through Native Apps

1. Transform Acquisition into Retention

Instead of constantly acquiring new customers, focus on converting your existing mobile web visitors into app users. Every app download represents a customer moving from rented to owned media.

Implementation: Use exit-intent overlays, SMS campaigns, and post-purchase flows to promote app downloads. Offer app-exclusive perks to incentivize the switch.

2. Maximize Customer Lifetime Value

Native apps excel at driving repeat purchases through personalized experiences, push notifications, and seamless checkout flows. Higher LTV means you can afford higher CAC when necessary.

Implementation: Build loyalty programs, personalized product recommendations, and exclusive content directly into your app experience.

3. Create Viral Growth Loops

App users are more likely to refer friends and family. Native sharing features, referral programs, and social commerce tools turn customers into advocates.

Implementation: Implement social sharing, referral rewards, and user-generated content features that encourage organic growth.

The Path Forward

Rising CAC isn’t a temporary blip—it’s the new reality of digital commerce. Brands that continue relying solely on paid acquisition will find themselves in an unsustainable arms race.

The solution isn’t to abandon digital marketing, but to rebalance your strategy. Use paid acquisition to fill your funnel, but convert those customers into app users who become part of your owned audience.

The brands that will thrive in this new landscape are those that:

- Build direct relationships through owned channels

- Focus on customer lifetime value over acquisition volume

- Create mobile experiences that drive loyalty, not just transactions

- Use first-party data to reduce dependence on platform targeting

Frequently Asked Questions About Rising CAC and Native Apps

Why is my CAC increasing even though I haven’t changed my ad strategy?

External factors have fundamentally altered how digital advertising works. Apple’s iOS 14.5 privacy changes eliminated 80% of tracking data that powered Facebook and Google’s targeting engines. With over 2 million active advertisers competing on Facebook alone, simple supply and demand economics have taken over. Third-party cookies are being phased out, creative assets burn out faster, and consumers have become increasingly skeptical of ads. These structural shifts mean your strategy may be the same, but the landscape has changed completely.

How much can a native app really reduce my CAC?

Native apps don’t eliminate acquisition costs, but they transform the economics by dramatically improving retention and repeat purchase rates. Brands using native apps see 2-3x higher conversion rates and 5x better retention compared to mobile web. This means you acquire customers through traditional channels but convert them to owned media where you can re-engage them without additional acquisition spend.

What’s the typical ROI timeline for a native app investment?

Based on customer data, brands typically see measurable revenue impact within the first 30-60 days of launch. Hobbycraft saw 14% of all digital revenue flow through their app within months of launch. E.L.F. Beauty achieved triple-digit growth in both revenue and downloads after moving to native. The key is that ROI compounds over time—every customer interaction strengthens the relationship without additional acquisition costs, creating a flywheel effect that improves with scale.

Is a native app worth it for mid-sized brands or just enterprises?

Native apps deliver value across brand sizes, though the specific ROI drivers may differ. Sosandar, a mid-market fashion brand, saw 2.7x higher conversion rates on their app versus mobile web, with nearly 5x better retention rates. The critical factor isn’t company size—it’s whether you have a customer base worth retaining and growing. If you’re spending significantly on customer acquisition and struggling with retention, a native app can fundamentally change your unit economics regardless of scale.

How do native apps compare to mobile web optimization for reducing CAC?

Mobile web optimization is important but has fundamental limitations that native apps overcome. Mobile web experiences are inherently fragmented—customers bounce between browsers, clear cookies, and switch devices, making attribution and personalization nearly impossible. Even the best mobile web experiences typically convert at only 50-75% of desktop rates. Native apps eliminate this fragmentation with persistent sessions, faster load times, push notifications for direct engagement, and rich first-party data you own and control. It’s not either/or—you need both, but apps provide capabilities mobile web simply cannot match.

What if my customers don’t want to download another app?

This concern is common but doesn’t match actual customer behavior when value is clear. Hobbycraft found that 47% of app downloads were new customer records, while Revolution Beauty discovered 63% of app shoppers were new customers. The key is providing genuine value—exclusive offers, easier checkout, personalized experiences, or loyalty benefits. Customers are selective about apps, but they enthusiastically download apps that make their lives easier or save them money. Focus on creating an experience worth downloading rather than assuming customers won’t engage.

How long does it take to launch a native app?

With modern app platforms like poq, enterprise brands can launch high-performing native apps in weeks rather than months. The platform provides pre-built commerce features, seamless integration with systems like Shopify, Salesforce and Magento, and proven app experiences out of the box. This is dramatically faster than in-house development, which can take 6-12 months and requires ongoing engineering resources for maintenance and updates. The key is choosing between building from scratch (slow, expensive, resource-intensive) versus leveraging a proven platform (fast, efficient, supported).

Will a native app cannibalize my web traffic and sales?

Data shows that apps expand the pie rather than simply shifting sales from web to app. Hotel Chocolat discovered that its app users visit 2x as often as web users, creating new purchase opportunities rather than replacing existing ones. Hobbycraft converted 13% of their store-dominant customers to multi-channel customers through the app. The app becomes an additional touchpoint that strengthens customer relationships and increases overall engagement rather than competing with other channels. Think of it as an increasing share of wallet rather than shifting where transactions occur.

What’s the biggest mistake brands make when trying to reduce CAC?

The biggest mistake is treating the symptom (rising CAC) rather than addressing the root cause (over-reliance on paid acquisition). Many brands respond to rising CAC by optimizing ad creative, testing new channels, or increasing budgets—essentially doubling down on the same approach that’s becoming less effective. The fundamental issue is dependence on rented media where you compete in auctions you don’t control. Smart brands rebalance their strategy by building owned channels like native apps that create direct customer relationships, reducing long-term dependence on paid acquisition while improving retention economics.

Your Next Move

If you’re tired of watching your CAC climb while your returns diminish, it’s time to explore the native app opportunity. The brands acting now—while their competitors remain stuck in the paid acquisition hamster wheel—will have a significant advantage.

The question isn’t whether mobile apps are worth the investment. The question is whether you can afford to wait while your competition builds direct customer relationships that bypass the advertising auction entirely.

Ready to break free from rising CAC? Your customers are already mobile-first. It’s time your strategy caught up.

Poq helps enterprise retail, DTC, and B2B brands turn mobile into their most valuable storefront. With our native app platform, brands reduce acquisition costs, increase retention, and scale faster—without the complexity of in-house development. Ready to transform your mobile strategy? Let’s talk.

You may be interested in...

Are Native Apps the Safest Channel for Digital Commerce?

The Download Barrier Is Dead: How App Clips Turn “Maybe Later” Into “Right Now”

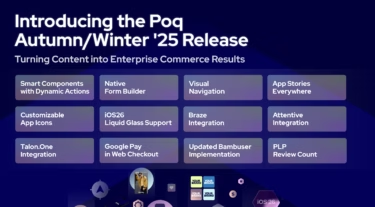

Poq Autumn/Winter ‘25 Release: Turning Content into Enterprise Commerce Results