Push vs Paid: The Strategic Battle for Customer Loyalty in 2025

23rd September, 2025

Push Notifications VS Paid Ads: The Acquisition Crisis Every Brand Is Facing

Your acquisition costs just hit $127 per customer. Last year, it was $78. Meanwhile, 73% of your new customers never make a second purchase.

The math is brutal: you’re spending more to acquire customers who buy once and disappear.

Rising digital ad costs. Shrinking marketing budgets. Consumer attention spans last mere seconds before scrolling to the next trend. When it costs more than ever to acquire a customer, with some brands seeing customer acquisition costs rise 60% year-over-year, can you really afford to neglect retention?

When the average consumer checks their phone 96 times per day, this is where the push versus paid conversation shifts from a nice-to-have to a business-critical one.

In today’s economy, the brands that thrive aren’t just the ones that can afford to keep spending on acquisition; they’re the ones that turn every new customer into a loyal, high-value repeat buyer.

Understanding Your Marketing Arsenal

Let’s cut through the noise and define what we’re actually talking about:

Paid Ads are your acquisition engine. Facebook ads, Google Shopping, and Instagram campaigns that interrupt consumers in their feeds and search results. They’re designed to capture attention and drive that first purchase.

Push Notifications are your retention powerhouse — direct messages that land on your customers’ lock screens, delivered through your native mobile app. They’re built to bring customers back, again and again.

Here’s the strategic reality: paid ads get customers in the door, but push notifications keep them coming back. One drives acquisition, the other drives customer lifetime value (CLV). And in the current economic climate, that distinction matters more than ever.

The strategic advantage? Native apps leverage push notifications more effectively, delivering superior engagement and conversion rates. Apps provide the infrastructure to shift customer relationships from one-off transactions into sustained lifecycle engagement.

The Strategic Comparison: Cost, Attention, and Long-Term Value

Cost & ROI Reality Check

Paid advertising operates on a pay-per-play model. Every impression, every click, and every conversion costs money, and those costs keep climbing. You’re essentially renting access to your customers through someone else’s platform.

Push notifications? Once you have a customer’s app installed, reaching them is virtually free. No bidding wars, no algorithm changes that reduce your reach overnight, no middleman taking a cut.

Consider this financial reality:

- A $100K paid ad campaign might acquire 1,000 customers. Without a retention strategy, 730 never return.

- Those same 1,000 customers in your app? Push notifications can re-engage them 52 times per year at near-zero cost, driving 3x more purchases over 12 months.

For CMOs: Stop renting customer attention. Start owning it.

For CFOs: Every push notification costs $0.01. Every Facebook ad click costs $0.70.

For CEOs: Your competitors fight for customers in expensive channels. Apps let you play a different game.

The Attention Battleground

Consider where these messages live in your customer’s world:

Paid ads compete in the chaos of social feeds, news updates, and your competitors’ campaigns. They’re fighting for attention in the noisiest digital spaces on earth:the average person gives a social post or ad about 1.7 seconds of attention before scrolling on, underscoring how fleeting paid impressions really are in feeds.

Push notifications arrive in a space consumers check 96 times per day, their phone’s home screen. They’re not competing with a dozen other brands for eyeball time. They’re getting undivided attention, even if it’s just for a few seconds.

And when that attention converts? The results speak volumes. Revolution Beauty achieved a 7% click-through rate on push notifications with a 24% conversion rate.

The CLV Game-Changer

This is where the conversation becomes particularly interesting for CFOs and CEOs focused on the bottom line.

Paid ads typically generate one-time buyers. You acquire a customer, they make a purchase, and then you need to spend again to bring them back, assuming you can even re-target them effectively with the changes to iOS privacy.

Push notifications drive repeat engagement. They nurture the customer relationship over time, increasing purchase frequency and average order value. A customer who downloads your app and engages with push notifications isn’t just a one-time buyer; they’re a compound asset that gets more valuable with every interaction.

CLV has become the metric that separates thriving brands from struggling ones. When budgets tighten and acquisition costs soar, brands that maximize value from each customer build unshakeable foundations.

Our data backs this up. Hotel Chocolat discovered that its app users visit twice as often as web users, creating massive opportunities for increased purchase frequency.

The math is simple: higher CLV means better margins, which implies resilience when economic conditions tighten.

Head-to-Head Strategic Comparison

| Factor | Paid Ads | Push Notifications |

| Cost | Rising CPCs, ongoing spend | Low cost, owned channel |

| Audience | New customers, broad targeting | Existing users, highly targeted |

| Timing | Awareness-driven, indirect | Real-time nudges, immediate action |

| Funnel Role | Top-of-funnel acquisition | Mid/low-funnel conversion & retention |

| Impact on CLV | One-time transaction focus | Directly boosts repeat purchase frequency |

| Long-term Value | Diminishing returns | Compound growth |

| Customer Data | Platform-controlled | Brand-owned |

| Message Frequency | Limited by budget | Unlimited engagement |

The Risk of Standing Still

The economic pressures aren’t going anywhere. Attention spans aren’t getting longer. Ad costs aren’t coming down.

But brands that build native mobile apps create a competitive moat. They own their customer relationships. They can drive retention without constantly paying for re-engagement. They turn acquisition costs into long-term assets rather than recurring expenses.

Every day without an app strategy:

- Your customer acquisition costs climb higher

- Competitors build deeper, more profitable customer relationships

- iOS privacy changes make retargeting more complicated and more expensive

- You remain dependent on rented audiences that platforms control

- Your best customers slip away to brands that own their attention

The Real Takeaway

Push and paid aren’t competitors.

They’re strategic partners in an integrated growth system. But the real differentiator for brands in today’s economic climate isn’t how much they can spend on acquisition. It’s whether they own a channel that builds customer lifetime value.

Apps create an owned engagement platform. They provide you with a direct line to your best customers. One that doesn’t depend on Meta’s algorithm changes or Google’s bidding wars. They transform one-time buyers into loyal, high-CLV customers who drive sustainable growth.

The winning formula: Every ad you run should not just bring a customer, it should get a future push subscriber. Use paid to acquire, then transition customers into owned channels where push drives ongoing engagement and compound value.

Ask yourself: How many of your existing customers could you re-engage right now without spending another dollar on ads?

If the answer is “not many,” you’re leaving money on the table while your competitors build customer moats.

The Strategic Reality

In 2025, winning isn’t about who spends the most on ads; it’s about who turns one-time buyers into loyal, high-CLV customers. And increasingly, apps are what make that possible.

Your app isn’t just another channel. It’s your flagship storefront in your customer’s pocket, built to scale, tailored to you, and designed to turn every acquisition dollar into lasting customer value. It’s your insurance policy against rising acquisition costs and your competitive moat in an attention-scarce world.

The question isn’t whether you can afford to build an app strategy; it’s whether you can afford not to.

Consider this strategic reality: while you’re renting customer attention for one-time transactions, your competitors are building relationships that compound customer value over time through their app.

The strategic choice is clear: rent customer attention for fleeting transactions, or own the relationships that build compound value.

The only question is, are you using apps to turn every customer into a compound asset, or letting them become someone else’s growth story?

Ready to explore how a native app could transform your customer relationships and drive compound growth? Let’s talk about your app strategy.

Let's talk about your app strategy.

You may be interested in...

Are Native Apps the Safest Channel for Digital Commerce?

The Download Barrier Is Dead: How App Clips Turn “Maybe Later” Into “Right Now”

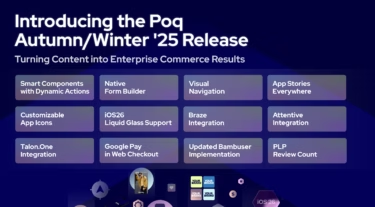

Poq Autumn/Winter ‘25 Release: Turning Content into Enterprise Commerce Results