BFCM 2025: The App Advantage and Why Retailers with Native Apps Were the Real Winners

Mobile web conversion rates remain stuck at 3.3% (less than half of desktop), while acquisition costs surge past $200 per customer. Here’s why retailers with native apps are capturing 5,000x better economics, and what it means for your 2026 strategy.

9 December, 2025

Black Friday Cyber Monday 2025 delivered record breaking numbers across the board. U.S. consumers spent $11.8 billion on Black Friday and $14.25 billion on Cyber Monday. Global sales hit $79 billion. Mobile dominated with 54% of all online sales.

But beneath these headline figures lies a more strategic story.

The retailers who won BFCM 2025 weren’t just those with the deepest discounts or biggest ad budgets. They were the ones who had invested in native mobile apps.

While web-only retailers fought for scraps in an increasingly crowded and expensive digital landscape, app-enabled brands captured disproportionate value, higher conversion rates, and built sustainable competitive advantages that will compound long after the holiday decorations come down.

The Market Reality: Everyone’s Fighting for the Same Mobile Customer

Let’s start with what everyone knows: mobile commerce is no longer the future, it’s the present.

Mobile accounted for 54-57% of all online sales during BFCM 2025, continuing a multi-year trend that shows no signs of slowing. 87.3 million Americans shopped online on Black Friday, with 78% of all retail website traffic coming from mobile devices.

But here’s where it gets interesting: while mobile traffic surged, mobile web conversion rates remained stuck at just 3.3%, less than half of desktop’s 6.5% conversion rate.

Think about that. Retailers are getting massive mobile traffic, but the majority of those visitors leave without buying. The mobile web experience, despite years of optimization, still fundamentally underperforms.

Unless you have an app.

The Performance Gap: Apps vs. Mobile Web

Our data from enterprise retail apps across the poq platform during BFCM 2025 revealed a stark performance divide:

Apps delivered consistently superior performance vs. mobile web:

- Basket size: +14% on average (up to +47% for top performers)

- Session conversion: +41% on average (up to +178% for top performers)

Even in categories or regions facing headwinds, app performance outclassed mobile web across every single KPI. This isn’t marginal improvement, it’s a fundamental structural advantage.

Industry data backs this up. According to recent research, mobile apps consistently outperform mobile websites in conversion rates, and 54% of all mobile commerce transactions now happen in shopping apps versus 46% via mobile browsers.

Apps account for 42% of consumer shopping preferences over websites, with Gen Z showing a 68% preference for smartphone shopping through apps.

The message is clear: when customers have a choice between your mobile web experience and your app, they choose the app and they convert at dramatically higher rates when they do.

The BFCM 2025 Winners: Apps Across Every Segment

Our portfolio generated +50% YoY revenue growth on Black Friday and 39% on Cyber Monday. But more revealing than the aggregate numbers was the breadth of success across customer types.

Youth-Focused Brands Dominated

Youth retailers saw explosive BFCM performance, with some achieving up to 10.9x their daily average revenue. These mobile-native Gen Z customers expect app experiences and when brands deliver them, the results speak for themselves.

Fashion led all categories with +35% app revenue growth, driven by customers who naturally browse, discover, and purchase through mobile. Apps enabled these brands to showcase collections dynamically, use push to drive urgency around limited inventory, and create exclusive app-only access that drove both downloads and conversion.

Mature Audience Brands Proved Apps Aren’t Just for Youth

But here’s what surprised many: brands targeting older demographics achieved equally impressive results.

Premium retailers serving 35+ audiences saw revenue multiples of 6.4x, 5.2x, and 4.5x daily average, proving that app success has nothing to do with customer age and everything to do with experience quality.

These customers value convenience, reliability, and premium service, exactly what native apps deliver. When done right, apps resonate with any demographic.

North America Led Growth at +53%

Regional performance showed dramatic differences. North America drove +53% app revenue growth, fueled by strong performance across all metrics: +68% new users, +51% active users, +60% transactions.

This reflects both market maturity in accepting app-first shopping and the success of brands that prioritized mobile apps as strategic channels rather than afterthoughts.

The Owned vs. Rented Channel Economics

Let’s talk about what BFCM 2025 really cost retailers who relied solely on paid acquisition.

Adobe reported that social media’s share of revenue grew 54.5% to reach 3.6% of total online sales. AI-driven traffic surged 805% as shoppers used chatbots to find deals. BNPL services processed $1.03 billion on Cyber Monday alone, as financially strained consumers sought payment flexibility.

All of this points to one reality: acquisition costs are rising, and customer acquisition has never been more expensive.

The average cost to acquire a customer through paid channels: $50-$200+ but the cost to re-engage an existing app user through push: $0.01

It’s not just cheaper, it’s 5,000-20,000x cheaper to engage customers you already have through your app than to acquire new ones through paid channels.

And those app customers? They’re worth more. Industry data shows app user lifetime value runs 3-5x higher than web-only customers, driven by higher frequency, larger baskets, and sustained engagement.

Mobile: The Highest Share of Digital Mix at 76%

Here’s the metric that matters most: Combined app and mobile revenue now represents 76% of the total digital mix, up from 74% in 2024 and 72% in 2023.

This isn’t a gradual drift, it’s an accelerating shift that’s fundamentally reshaping retail.

Breaking down growth rates:

- App revenue: +23% YoY

- Mobile web revenue: +18% YoY

- Desktop revenue: +1% YoY

Apps aren’t just growing faster than other channels, their penetration increased from 20% to 24% of total mobile revenue year-over-year. The gap is widening.

Apps averaged 19% of total online revenue and 24% of total mobile revenue across our customer base, with top performers reaching 56-60% of their business through apps.

For context: while the broader market saw mobile account for 54% of sales, app-enabled retailers were capturing nearly double that share through their owned channel.

Cyber Monday Told an Even Stronger Story

While Black Friday grabbed headlines, Cyber Monday revealed the true power of app strategies.

Cyber Monday delivered stronger year-over-year growth across behavioral KPIs:

- App revenue growth: 39% CM vs 23% BF

- Transaction growth: 41% CM vs 24% BF

- Session conversion growth: 16% CM vs 2% BF

Why? Because Cyber Monday rewards retention and re-engagement, exactly what apps excel at. While Black Friday rewards paid acquisition scale, Cyber Monday rewards owned audience activation.

Brands with apps could re-engage their entire user base through push notifications, driving them back into high-converting app experiences. Web-only retailers had to continue paying for every click.

The Strategic Imperative: Apps Are Competitive Moats

The most important insight from BFCM 2025 isn’t just that apps performed well. it’s that the performance gap between apps and web-only strategies continues to widen.

As acquisition costs rise across paid channels, as organic search becomes increasingly mediated by AI, and as customer expectations for personalized, convenient experiences grow, apps represent one of the few channels where retailers can:

- Own the customer relationship without platform intermediaries

- Engage at near-zero marginal cost through push notifications

- Capture disproportionate share of customer lifetime value

- Build genuine competitive moats through habit formation

During BFCM, the number of active users engaging with apps across the poq platform was up 24% year-over-year. The number of downloads during the peak period demonstrated continued customer appetite for better mobile experiences.

This represents a sustainable, compounding advantage. Every download is a customer relationship you own. Every push notification is an opportunity to drive revenue without paid acquisition. Every session reinforces the habit that makes your app the default shopping destination.

Web-Only Retailers: The Hidden Cost of Not Having an App

While app-enabled retailers captured outsize value during BFCM, web-only retailers paid a hidden tax:

Higher acquisition costs: Every customer required paid acquisition. No owned re-engagement channel meant continuous spending just to stay visible.

Lower conversion rates: Mobile web’s 3.3% conversion meant massive traffic leakage. For every 100 visitors, 96-97 left without buying.

Minimal customer loyalty: Without push notifications or app-exclusive experiences, building lasting relationships proved nearly impossible.

Dependency on platform algorithms: Visibility required paying Google, Meta, and TikTok. Algorithm changes meant immediate revenue impact.

Inability to capture peak performance: Even with successful BFCM traffic, web-only retailers couldn’t match the conversion rates or basket sizes that apps delivered.

The opportunity cost is staggering. If you drove 1 million mobile web visitors during BFCM at 3.3% conversion, you generated 33,000 transactions. Had those same visitors been in your app converting at 4.6% (a 41% uplift), you’d have generated 46,000 transactions, an additional 13,000 sales from the same traffic.

2026 and Beyond: The App Imperative

BFCM 2025 demonstrated conclusively that native mobile apps are no longer a “nice to have”, they’re a strategic imperative for any retailer serious about sustainable growth.

The brands that will win in 2026 and beyond aren’t those with the biggest marketing budgets. They’re the ones who:

1. Build Owned Channels

Stop renting customer attention from platforms and start owning direct relationships through apps.

2. Deliver Native Experiences

Web-wrapped apps and hybrid frameworks can’t compete with fully native iOS and Android experiences. Performance matters.

3. Activate Through Push

24% conversion rates from push notifications make it the highest-ROI channel in retail.

4. Create Compound Value

Every app download creates a relationship that compounds over time. The sooner you start, the faster your flywheel spins.

5. Differentiate Through Experience

In a world where everyone sells similar products at similar prices, your app becomes your competitive moat, the owned experience that customers prefer.

The Choice Is Clear

The results from BFCM 2025 aren’t subtle. They’re definitive.

Retailers with native mobile apps captured higher share, better conversion, larger baskets, and more engaged customers, while spending less on acquisition and building more sustainable competitive advantages.

Retailers without apps fought for scraps in an increasingly expensive paid acquisition landscape, dealt with conversion rates half of what they should be, and built zero lasting customer relationships.

The question isn’t whether apps will become essential, the data shows they already are. The question is whether your brand will be among the leaders capturing this opportunity, or among those playing catch-up in 2026.

Your app isn’t just another channel. It’s your flagship storefront, built to scale, tailored to you, and delivering results that mobile web simply cannot match.

Ready to see what native apps could do for your peak season performance? Get in touch to learn how enterprise retailers are turning mobile apps into their most valuable channel.

About the Data: Performance data compiled from enterprise retail brands using the poq native mobile app platform during Black Friday (November 29, 2025) and Cyber Monday (December 2, 2025). Brands represent Fashion, General Merchandising, Health & Beauty, and specialty retail categories across North America, EMEA, and ANZ markets. Industry benchmarks sourced from Adobe Analytics, NRF, Salesforce, Mastercard SpendingPulse, and Shopify covering the 2025 holiday shopping season.

You may be interested in...

Are Native Apps the Safest Channel for Digital Commerce?

The Download Barrier Is Dead: How App Clips Turn “Maybe Later” Into “Right Now”

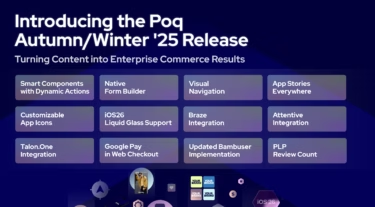

Poq Autumn/Winter ‘25 Release: Turning Content into Enterprise Commerce Results